Governor Abbott is taking radical steps to reduce your property taxes.

Throughout his gubernatorial tenure, Governor Abbott has signed sweeping property tax reforms. Besides delivering the largest property tax cut in Texas history — $18 billion — the Governor drastically raised the school-district homestead exemption for all Texans – from $100,000 to $140,000. He also boosted the homestead exemption for elderly and disabled Texans. Lastly, he raised the business personal property tax exemption from $25,000 to a whopping $125,000, while also making the veteran-owned business franchise tax exemption permanent.

But let’s be honest — you did not feel these reforms, because local governments raised your taxes, wiping out the savings. The Governor knows this and understands that there is still major work to be done. The cost of living and lack of affordable housing is a nationwide crisis. That’s why, in his next four years, Governor Abbott will push the Texas Legislature to adopt a truly transformative property tax plan.

This is not the first time that Governor Abbott has pressured the Legislature to make meaningful property tax reforms. Like his battle to pass school choice, he offered the Legislature the easy way or the hard way to pass his property tax agenda. But the Legislature did not act. This time, the Governor is playing hard ball.

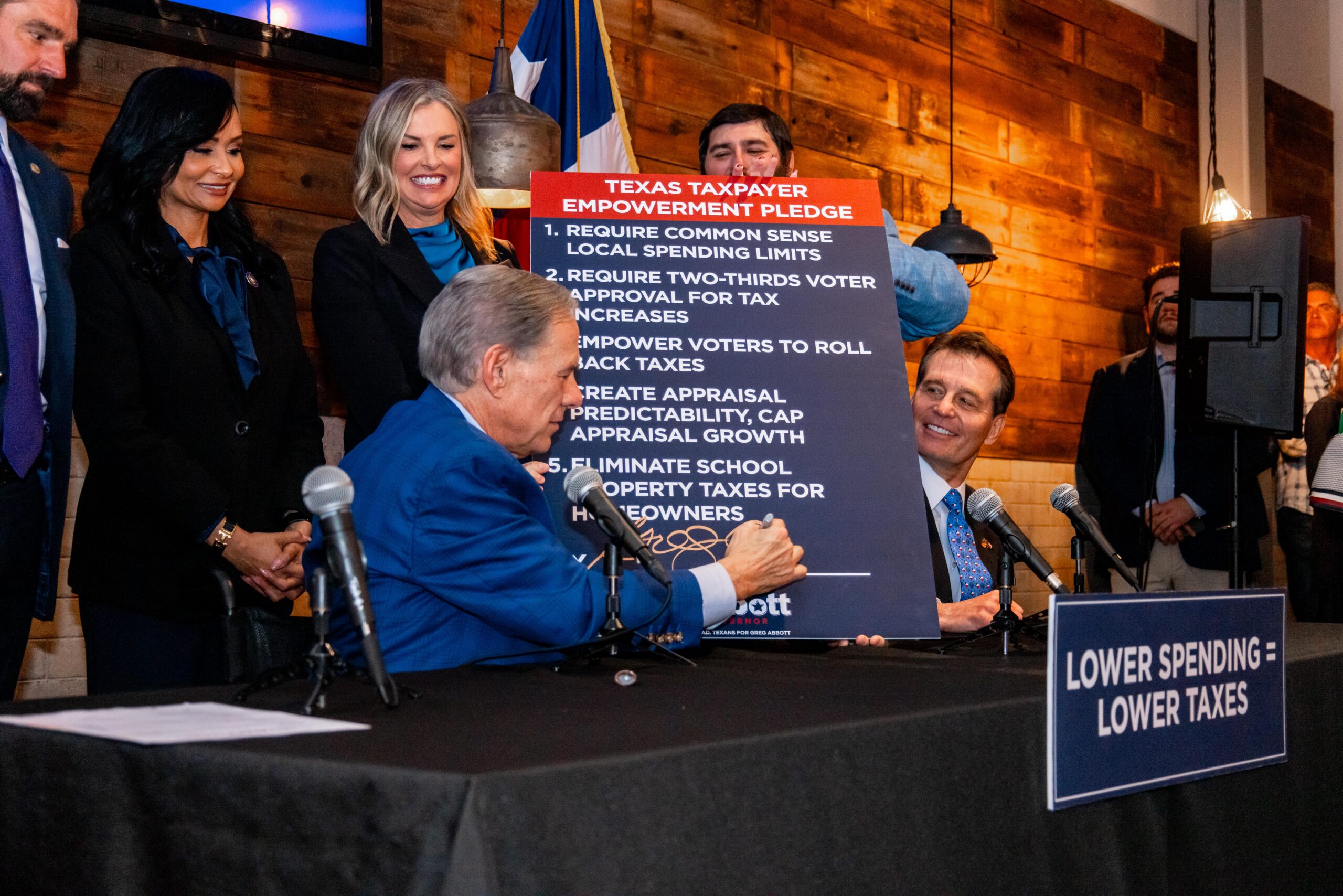

The Governor is ensuring that only pro-tax reform Republicans make it into the chamber next January. Conservative legislators are being brought to the negotiating table by signing — in front of the entire Texas public — the Governor’s five-point plan to meaningfully reform property tax law in Texas. Pictured below is the Texas Taxpayer Empowerment Pledge that all Republican legislators must get on board with, lest they lose their seats:

Local jurisdictions, the bodies that impose all the property taxes in the state, must learn to live within their means, just like the citizens they represent. That’s why ALL property tax increases must be voted on and approved by two-thirds of voters. 1.1% of voters must not make the tax decisions for the rest of their community. Importantly, Texans also must be allowed to change their minds and vote to roll back rate increases.

House appraisals – a constant source of runaway rates – must only occur once every five years, not once a year. And your appraisal cap should be slashed from 10% per year to 3%. Lastly, Texans should have the opportunity to decide at the ballot box to abolish the school district property tax, which constitutes two-thirds of the average Texan’s property tax bill.

Texas homeowners and renters are being squeezed as their local jurisdictions tout bloated budgets. This must end. Your community must manage their money, balance their checkbooks, and only spend your hard-earned tax dollars on the essentials. With Governor Abbott in charge, taxing authorities know they will have to make their budgets sane again.

No more will Texas go through the same charade. No more will we pass on debts to our future generations. Power will be restored to the people, the taxpayers that keep the state running. The American dream of homeownership will be back on the table, and you will no longer worry about opening that appraisal letter coming in the mail.